Updated: July 10, 2024

The continuous rise in housing prices has put a significant strain on the finances of current and potential home buyers. One in four millennials said they would likely always rent rather than buy a home. In an era where housing is of significant concern among households, homeowners need to know the difference between leasehold vs freehold properties.

Freehold vs Leasehold

When buying a house, you might come across the terms freehold and leasehold. Though they might seem confusing at first, their meanings are actually quite simple:

Freehold- Owning a freehold property means you have full ownership of both the building and the land it stands on.

Leasehold- A leasehold property sits somewhere between owning and renting. You own the building, but the land it’s on still belongs to someone else.

What is a Freehold Property?

A freehold property gives you complete ownership of the property and the land it is built on. You can alter, modify, construct, or remodel the property without consulting a landlord. As a freeholder, you don’t have to pay anyone ground rent, service charges, or administrative fees to a landlord. You are responsible for the property, contractor insurance, taxes, and fees.

Suppose you want to become a property investor. You can become a freeholder by leasing your property to other property managers, collecting ground rent, or venturing into Airbnb arbitrage. Arbitrage allows you to pay for your rent through the rental income you earn from subleasing your property. You can treat any excess as your additional income.

What is a Leasehold Property?

A leasehold property is in between owning and renting a property. In this case, you own the building but not the land it is built on.

Leaseholds also require upfront fees, with ground rent usually paid annually or bi-annually. While there is no standard for upfront fees for acquiring a leasehold, home buyers should remember that upfront fees to acquire a leasehold are usually lesser than that for a freehold.

In leasehold property, tenants must also pay service charges and administrative fees. Ground rent can escalate depending on contract terms.

Legal Differences Between Freehold vs. Leasehold

The main difference between leasehold and freehold ownership is in the form of ownership.

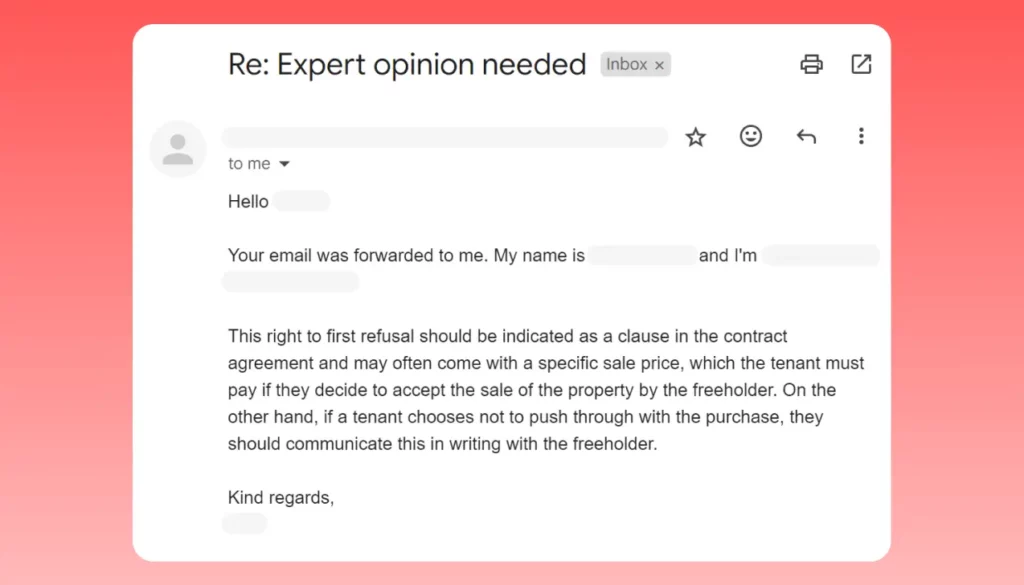

Right to First Refusal

If you have a leasehold property and a freeholder eventually decides to sell it, the current owner holds the right to first refusal. This means that your property’s owner has to offer to sell it to you before putting it on the market.

Payment of Property Taxes, Fees, and Other Governmental Dues

Generally, the freeholder is responsible for paying property taxes, permits, and other legal fees required, even if they are not actively using the property. However, it is common for both the freeholder and the leaseholder to agree that the lessee either shoulders the burden or divides it equally amongst themselves.

For every mutual agreement to be valid and binding, it must be recorded in the lease contract.

Renewal and Extensions

A leasehold has to be constantly renewed after a certain period. If no amendments are made to the original contract, the leasehold will revert to the owner, meaning you will lose any property rights as a leaseholder. These extensions may be made at additional costs.

However, these do not apply to freeholding as you wholly own the property in perpetuity.

Inheritance

A freeholder, with full ownership of the property, can pass down their property generationally without constraints or limits as long as the property is in their name. In a leasehold, the lessee can still transfer or assign the leasehold rights until the end of the original leasehold, subject to the property owner’s approval.

Key Considerations for Buyers and Sellers on Freehold vs Leasehold

Before deciding between a freehold and a leasehold, potential homeowners should consider the following:

- Cost and Budget: Freeholds are generally more expensive as you buy property and land. Leaseholds are a less costly option, involving an upfront fee and annual ground rent. Leaseholders can sublease through platforms like Airbnb and use tools like PriceLabs Market Dashboard to track rental data and price listings.

- Modifications: Freeholds allow significant modifications without approval. Leaseholds may require prior approval from the freeholder, who can disapprove changes.

- Risk and Responsibility: Freehold ownership means managing the property entirely, whether for personal use or lease. Leaseholders have fewer responsibilities, often handled by the freeholder unless otherwise agreed.

- Location: Sellers should consider the property’s location for a good ROI—close to establishments, transport, markets, etc. PriceLabs Market Dashboard can help understand market performance in the area.

- Revenue: Sellers need to evaluate a property’s revenue potential. PriceLabs Revenue Estimator Pro provides insights based on location, competitors, and market conditions.

- Amenities: Buyers and tenants seek homes with the best amenities. Sellers should ensure that in-demand amenities are installed. PriceLabs Market Dashboard can identify which amenities are popular in the locality.

Frequently Asked Questions

Is a Freehold Better Than a Leasehold?

It depends. Your home choice ultimately boils down to your needs and capacity. A freehold may be better if you want complete autonomy and ownership over their property and have the resources to buy it outright. A leasehold may be the best choice if you want minimal risk and responsibilities and have limited resources to pay substantial upfront fees otherwise required by a freehold.

How do Leasehold vs Freehold Properties Affect Property Values?

Leasehold leases with shorter terms are risky. The length of the lease determines the value of a leasehold property. In the case of a freehold, you claim ownership of both the property and the land whose value appreciates over time.

What Are Common Leasehold Disputes, And How Do You Settle Them?

Common leasehold disputes:

- Non-payment of rent and other fees

- Service charge disputes

- Repair and maintenance disputes

- Neighbor disputes

- Lease extension disputes

- Enfranchisement disputes

These disputes can be taken to court because a contract exists between the landlord and the tenant.

Key Takeaways on Freehold vs Leasehold Properties

- Purchase freehold instead of leaseholds if you want total control, ownership, and responsibility for their properties.

- Consider leasehold if you have stricter budget constraints but want longer than typical short-term leases.

- Upfront costs are higher for a freehold than a leasehold property; however, you will not pay service charges, regular rent, or administrative fees.

- Regular leases differ from leasehold properties, especially in the length of stay. Regular leases only require 1—to 2-year renewable contracts, while leasehold tenancies run for 40—to 100-year terms.

Conclusion

Finding the right home involves many challenges. Budget constraints, safety, location, and necessary modifications are key considerations. Investing in a home that fits your needs is crucial. Understand the difference between leasehold and freehold properties. Seek professional guidance to choose the best type of home. This ensures you avoid legal issues with your property. A proper understanding helps your family live comfortably without worries. Consider all factors for a wise investment.